CBI Special Director shines light on bank fraud trends

Special Director CBI Praveen Sinha speaking on the methods of bank frauds in India. Photo by Pragya Singh

By Pragya Singh

The

The first session ‘Labyrinth of

In the session, Praveen Sinha highlighted the methods of bank frauds in India with the CBI being the nodal agency investigating such frauds in India.

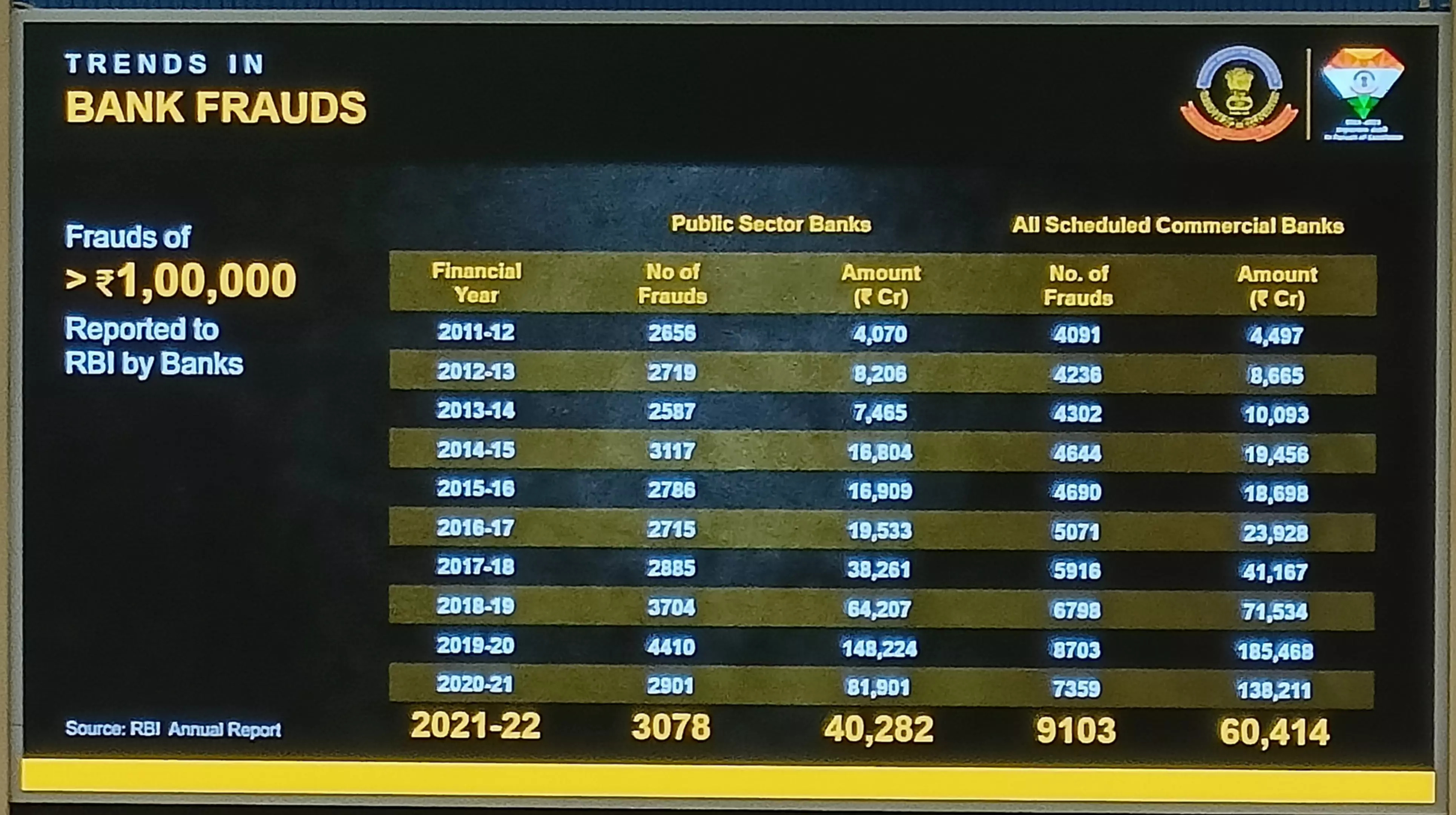

For all frauds of more than Rs 1 lakh, the RBI has reported an increase in the number of such frauds in recent years, Sinha said in his speech. However, the amount misappropriated in public sector banks has been on the decline with Rs 40,282 crore embezzled in the financial year 2021-22 compared to Rs 81,901 crore in the previous year, according to the RBI Annual Report.

Furthermore, a similar trend was seen for commercial banks with the swindled amount falling to Rs 60,414 crore in 2021-22 as compared to Rs 1,38,211 crore reported in 2020-21.

Talking about the enormity of the money lost in the bank frauds, Sinha cited the example of an infamous fraud committed by an airlines company launched in 2005. The banks reported a principal loss of Rs 6,200 crore while another Rs 1,100 crore was lost in the form of investment in shares. The loan was taken on inflated profits and revenue figures.

He said that the general tactics used in such ‘high-value advance bank frauds’ is misrepresentation and showing inflated figures to avail higher loans. Along with this the purported supplier or counterparty is often fictitious.

“The area of concern includes inadequate due diligence especially when foreign entities are involved,” Sinha said. He added that another factor that needs attention is that banks are influenced by the reputation of the borrowers and often undue relaxation is given to the borrowers in such cases.

(The writer is a Semester IV student of BA (Journalism and Mass Communication) programme.)

Recent Messages ()

Please rate before posting your Review

SIGN IN WITH

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.